Case Studies

Using Financial Statements

Topic: Underestimated Reserves for Debt Expense

Community Health Systems (CHS) is a Tennessee-based provider of hospital healthcare services founded in 1985. CHS added more than 70 hospitals in 2014 and acquired a Florida-based Health Management Associates for UD$ 7.6 billion. The company has also made a substantial investment in Tennessee with a USD$ 66 million satellite office. In 2023, CHS completed its spin-off of Quorum Health Corporation (QHC), an operator of general acute care hospitals and outpatient services. QHC was born from the spin-out of 38 hospitals and its hospital management along with consulting business Quorum Health Resources. The new spin-off owns and leases a well-diversified portfolio of more than 30 affiliated hospitals with about 3,4000 licensed beds. CHS was hoping that the combination of two companies would create shareholder value and capitalize opportunities for sustainable growth. Its net operating revenues totaled US$ 3.181 billion in 2023, with adjusted EBITDA of US$ 386 million.

In 2006, CHS owned 77 hospitals in 22 states and generated UD$ 3.7 billion in revenues in fiscal 2005. CHS made money mostly for its services from government agencies, private insurers, and non-insured patients. Medicare was the largest revenue provider for the CHS with 33% of net operating revenue in the quarter ended June 30, 2006. 25% came from managed care facilities, 10% from Medicaid, and 13% from self-pay patients. In 2005 CHS estimated its Allowance for Doubtful Accounts at 32.5% of gross receivables. Little did CHS know that they failed to differentiate among the risk characteristics of different classes of patients, and failed to recognise that the accounts for self-pay patients had the lowest collection rates. Many self-pay patients did not pay on time or neglected to pay at all. So, there had been an increase in the proportion of accounts receivables and revenues from these patients. Because of the low collection rates, CHS’s 2006 receivable allowances of 32.5% were understated. Serious adjustments needed to be made to “accounts receivable”, “deferred tax liability” and “retained earnings”.

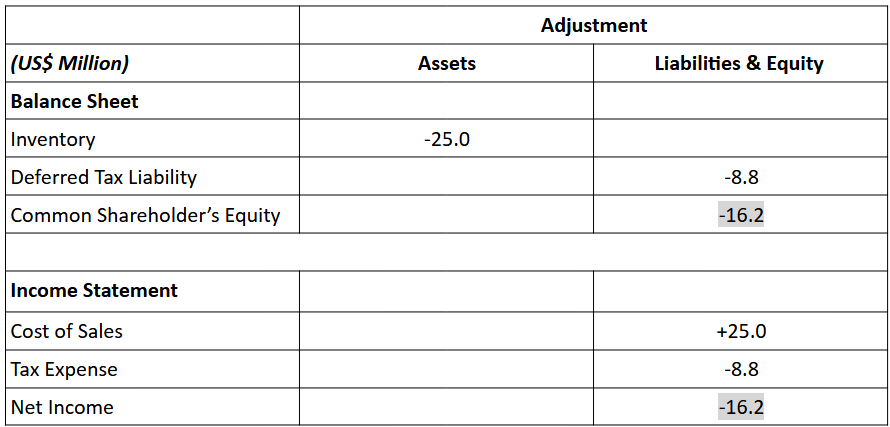

Adjustments:

- Percentage of allowance for doubtful accounts goes up to reflect the change in patient mix.

- Accounts Receivable go down as some patients would never end up paying.

- Earnings, Equity and Deferred Tax Liability to be reduced.

The main takeaway:

CHS needed to change its methodology for estimating the Allowance for Doubtful Accounts and establish an estimated separate default rates for self-pay patients and other accounts receivables to reflect the differences in collection history. This would help the company to recognize potential debt expense earlier and more accurately.

Topic: Asset Overstatement

Creative Technology Ltd., also known as Creative Labs Pte Ltd. was founded in 1981, the success of its audio interface led to the development of other sound technologies in the 1990s. The company ventured into the CD-ROM market and had to write off nearly US$ 100 million in inventory when the market collapsed due to cheaper alternatives in 1996. In 2004, the company announced a $100 million marketing campaign to promote its digital audio products, such as ZEN range of MP3 players.

Creative Technology had a very promising revenue growth from sales of portable MP3 Players between end of 2003 and the first quarter of 2005. But, its gross margins declined from 35% to 23% during this period. Apparently, growth in inventory had far outpaced growth in sales with 58% increase in days’ inventory. Inventory was valued at US$ 451.2 million by early 2006. Creative Technology’s high inventory value and potential obsolescence of its MP3 players had sent out negative vibes to its investors. After observing the speed of new product launches for MP3 players, comparing against the performance of other similar companies, it was inevitable that Creative Technology would be forced to record future inventory impairment charges. By end of 2005, it was clear that Creative Technology’s inventory was overstated and facing the write-down. The company took an inventory write-down and had to take a US$ 20 million

charge against inventory to reflect a decline in prices of its components used to make MP3 players. The company’s share price subsequently tumbled to the news of the write-downs of assets, it dropped by $12 per share from early 2005 to mid-2006. The stock traded at less than $5 per share by end of 2006.